Share This

CIBC SWIFT/BIC Codes

When it comes to sending money internationally, having the correct banking information is crucial. If you’re looking to send funds to the Canadian Imperial Bank of Commerce (CIBC), understanding their SWIFT/BIC codes is essential (by the way, take a look at the best Canadian online bank accounts: those are convenient!).

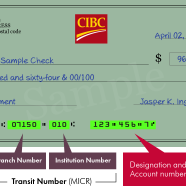

CIBC SWIFT code is CIBCCATTXXX. This unique code helps identify the specific bank and branch involved in an international transaction. It consists of four letters representing the bank’s name, two letters identifying its country location, and three optional characters denoting a particular branch or department.

However, if you are sending funds from the United States to a CIBC account in Canada, there may be additional information required due to correspondent banking relationships. In this case, Wells Fargo acts as CIBC’s correspondent bank in the US. To complete your transfer successfully, provide your sender with both an ABA number and a SWIFT number:

- ABA Number: 026005092

- SWIFT Number: PNBPUS3NNYC

Including these details along with CIBCCATTXXX when initiating your payment from within the US ensures that it reaches its intended destination at CIBC effectively.

CIBC SWIFT Code Breakdown: Why do I Need the CIBC SWIFT code?

| SWIFT code CIBC | CIBCCATTXXX |

| Bank Code | CIBC |

| Country Code | CA |

| Location Code | TT |

| Branch Code | XXX |

If you are conducting international financial transactions or sending/receiving money from abroad, it is essential to have the correct bank identification information. One crucial piece of information required for these transactions is the CIBC SWIFT code.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) provides a standardized format for identifying banks and financial institutions worldwide. The SWIFT system ensures secure and efficient communication between different banks across borders.

In Canada, one prominent bank that uses the SWIFT network is the Canadian Imperial Bank of Commerce (CIBC). CIBC’s unique identifier within this global network is its specific 8-character alphanumeric code known as a SWIFT code for CIBC Canada or CIBC BIC code (Bank Identifier Code).

Here are some reasons why understanding and having access to SWIFT code for CIBC Canada can be beneficial:

- International wire transfers: When transferring funds internationally, your recipient will require your banking details along with CIBC’s specific Swift/BIC Code in order to receive the money securely and efficiently.

- Receiving funds from abroad: If you’re expecting an incoming international wire transfer into your CIBC account, providing both your personal account details as well as CIBC’s Swift/CIBC BIC code will ensure smooth processing without any unnecessary delays.

- Direct debits/deposits: In certain situations where direct debits/deposits originate overseas – such as pension payments or dividends – knowing which institution holds your accounts becomes important so that they may process these requests promptly.

- Verification purposes: Sharing accurate banking details like a SWIFT/BIC number acts as proof of identity during various verification processes related to cross-border fund transfers.

- Efficient correspondence between banks: Using standard codes like Swift/BIC helps facilitate the quick exchange of necessary information among different banks involved in a transaction instead of relying on manual correspondence methods alone.

Remember that while SWIFT codes for CIBC Canada are essential for international financial purposes, they may not be required for domestic banking operations within Canada.

Having access to and understanding CIBC’s SWIFT/BIC Code allows for secure and efficient communication between banks during international money transfers. This knowledge will help streamline your cross-border transactions, ensuring a smooth flow of funds without unnecessary delays or errors.

Do Canadian Imperial Bank Of Commerce (CIBC) SWIFT codes change from branch to branch?

When it comes to sending or receiving money internationally, one of the key pieces of information required is the SWIFT code CIBC. This unique code helps ensure that your funds are directed to the correct financial institution and specific branch.

For customers of the Canadian Imperial Bank Of Commerce (CIBC), each individual branch does indeed have its own unique SWIFT code for CIBC Canada. However, if you’re unsure about which CIBC bank code applies to your particular CIBC branch or cannot find it easily, there is an alternative solution available.

You can use the 8-character head office SWIFT code for CIBC: CIBCCATT. By using this general identifier instead of a specific branch’s swift code, your payment will still be successfully directed to your account at any CIBC location across Canada.

This simplified method allows for easier international transfers without having to search for different CIBC bank codes depending on where you are located within Canada. It also ensures that even if there are changes in branches or their corresponding swift codes over time, you won’t need updated information every time you want to send or receive money through CIBC.

It’s important when conducting online banking transactions with other countries that not only do you have access and knowledge about proper exchange rates but consider fees charged by both banks involved in transferring cash between accounts as well – these may vary significantly between institutions based on services offered like speediness vs. cost-effectiveness during transfer processes.

It’s important to note that while international transfers can be initiated online through CIBC, it may take some time for the funds to reach their destination – this depends on factors like intermediary banks involved or specific country regulations governing cross-border transactions.

In addition to a CIBC SWIFT code and online banking services, CIBC offers various other financial services, including debit cards, which provide immediate access to your checking account balance at any ATM worldwide where Visa/Mastercard are accepted. These virtual debit cards allow you more flexibility when traveling abroad by removing concerns about carrying large amounts of cash or currency exchange fees incurred during purchases made outside Canada. Business credit cards are pretty convenient as well.

Receiving Money From Abroad

Of course, we understand the importance of receiving money from abroad and minimizing costs associated with international transfers. One common question that arises in this process is whether one needs to provide a CIBC SWIFT/BIC code.

If you are expecting a transfer from abroad and your sender requests a CIBC SWIFT/BIC code, it’s essential to be aware that traditional bank transfers can incur high fees and unfavorable exchange rates. This often results in recipients receiving less than they should have received after deducting these expenses.

For instance, if someone were sending $1,000 USD from the United States using their local bank account without considering alternative options like Wise Account (formerly TransferWise), they might face total fees between 5% and 10%. When converting this amount into Canadian dollars at prevailing market rates through such channels, you could expect around CAD$1,100 instead of CAD$1,259 – leading to approximately CAD$100 lost due to excessive charges levied during the transaction.

Fortunately, there exists an excellent alternative called Wise Account, which allows individuals and businesses based in Canada or other countries to access cost-effective solutions for international money transfers. By utilizing Wise Account’s features designed specifically for Canadians seeking efficient cross-border payments management:

- You will receive local bank account details denominated in ten different currencies.

- You’ll benefit from mid-market exchange rates when sending or receiving funds.

- Fees charged by Wise are transparently displayed upfront so there won’t be any surprises.

- The platform offers convenience; users can hold multiple foreign currencies alongside Canadian dollars within their accounts.

- It enables spending directly using both domestic currency balances as well as foreign currency balances.

By opting for a Wise Account, you can receive money from abroad as if you were operating with a local bank account. This allows for substantial savings due to competitive exchange rates and low fees provided by the platform.

It is important to note that while CIBC SWIFT code Canada (or BIC) may still be required in certain situations, using Wise’s services offers significant advantages when it comes to receiving funds internationally. The ability to hold multiple currencies within your account and access mid-market exchange rates ensures that you maximize the amount received without losing out on unnecessary charges or unfavorable conversion rates associated with traditional banking methods.

Sending Money Internationally: Considerations Beyond BIC/SWIFT Codes

While knowing an accurate BIC/CIBC SWIFT code Canada like those mentioned above is important for successful transactions involving financial institutions such as CIBC or any other major banks worldwide, it’s equally vital to consider alternate methods of transferring money internationally.

Traditional methods relying on local banks often come with fixed fees that can quickly add up over time, coupled with unfavorable exchange rates compared to market rates available elsewhere.

Based on our analysis conducted across around 50 prominent banks globally specializing in eight countries’ remittance costs, sending money through traditional channels isn’t always optimal when it comes specifically to transferring funds into Canada via a local bank.

Bank transfers through the SWIFT network can be time-consuming, taking between one to five business days on average. If you need a speedy transfer, this may not be your best option.

Thankfully, more intelligent alternatives exist for international money transfers. Digital money transfer providers offer cost-effective and efficient solutions that could save you up to 95% in fees compared to traditional banks while ensuring quicker delivery of funds into your CIBC beneficiary’s account.

By utilizing these digital platforms, you gain access to competitive exchange rates and significantly reduced transaction costs without compromising speed or reliability. These services often provide transparent fee structures upfront so that there are no surprises when it comes time to send money internationally.